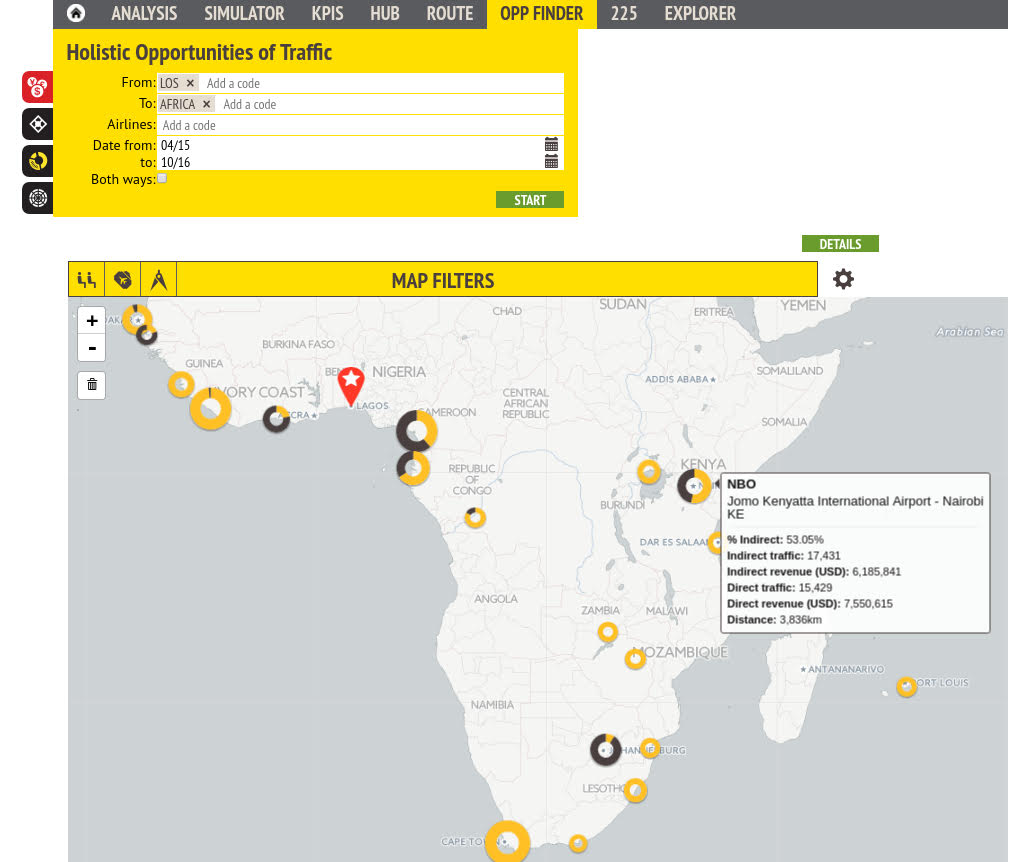

Planning expansion in the African aviation market.? Our Planet Optim software gives instant insights into likely passenger volume and revenue.

Christophe Ritter is the COO and co-founder of Milanamos. He has written the article below for the May 2017 edition of the AFRAA Africa Wings magazine.

“The low cost air carrier model has been successful in most regions of the world. It’s a concept initially thought through and started by the Smiliner Pacific Southwest Airlines in the 70s in California, and further refined and industrialized by Southwest Airlines across the USA. With deregulation and other legislative changes, it was successfully duplicated in Europe with Ryanair and EasyJet in the 90s, as well as GOL in Latin America and multiple air carriers in Asia.

However – and despite the lack of road and rail infrastructures that should favour air transport – the low cost carrier model never took off in Africa, despite many attempts, with the exception of South Africa where there is a large domestic demand.

Launching a low cost carrier venture in Africa.

There are many challenges specific to Africa that might explain the relatively unsuccessful attempts by various investors to set up a profitable African low cost carrier. Actually, our opinion is that a lot of the time these issues have been used as a smoke screen to cover some gross mismanagement, as well as a lack of adaption of the low cost carrier (LCC) model to the African air transport environment.

However, the way the automotive industry addressed its development in emerging markets with a low cost offer gives us some good perspectives on the do’s and dont’s of implementing such a business model. This has helped us to identify five success factors that should be used by any investor hungry for success in the low cost African market.

The automotive industry is very similar to the airline industry since global manufacturers had to develop their own low cost offer, and sometimes brand, to stimulate the demand for more affordable cars that can be sold in almost all continents and countries. In a similar way to how low cost airlines operate, and to how distressed inventory pricing from the traditional air carriers opened air transport to a new clientele, car manufacturers offered entry-level models to increase the passenger vehicle per inhabitant in developing countries. A recent study across 140 countries demonstrated the very strong correlation between vehicle penetration and GDP per capita (1). The GDP growth is a precursor to a growing disposable income for the population, adding to the high net worth individuals who can afford luxury models and new buyers from the nascent middle class.

One of the largest predicted automotive markets is in the Indian subcontinent, which has attracted all major international car manufacturers to the region. India’s economy is booming (2) and it is expected that India’s share of the World GDP will increase from 2% in 2005 to 17% in 2050. This long term growth will change the structure of consumption, with more expenses related to travel and transportation. It is already a reality today on the aviation market since India is among the five fastest-growing aviation markets globally with 275 million new passengers in 2015, and its domestic air traffic is expected to cross 100 million passengers by 2017 (3). In fact, India is expected to be the third largest aviation market by 2020, up from its current position in 9th place on the list of civil aviation markets.

The automotive market is dominated by Japanese and European car manufacturers who are adapting their traditional offer with entry level models, often built from amortized toolings, technical platforms and engines. This was actually the strategy followed by Renault with the Logan program and its various derivatives. This recipe proved to be a success, moving the non-European sales of the company from 25% to 50% of its worldwide production. But it was still a failure in India, with limited sales and even a retreat from the market after about two years. In 2016, one year after launching its new entry-level product called Renault Kwid, the company is selling 10,000 units of it every month, enjoying a 5% market share (starting from zero) and is already surpassing all its European competitors who have been present for years in the Indian market. How did the company manage to successfully come back on this challenging market, and produce a profitable brand new $3,500 car? (4)

The answer is that instead of trying to recycle the old recipe adapted from developed countries’ standards, Renault Kwid is the first example of a car designed, engineered and produced for the needs of underdeveloped markets. The entire project was articulated around two key conceptual elements: fractal logic and intrusive oversight.

The fractal logic came from the idea that all elements will be designed from a clean sheet of paper – body parts, engine, gear box, etc. – simultaneously and in a coordinated fashion. The additional complexity of starting from scratch also represented an opportunity to remove all constraints related to one or more specific elements, which challenged the established development standards. Therefore the overall engineering of the car allowed massive cost reduction by moving away from the logic of adding separate elements, opting instead for a transversal approach focusing on customer logic and back-engineering to build components.

The intrusive oversight can be summarized thus: stop copying and pasting solutions that you know, but instead look for solutions within your environment. The management process should not be isolated but rather be positioned at the forefront, with the team actively looking for new solutions against strategic targets. Being profitable on a brand new modern car sold for $3,500 required the Renault team to drive the engineering towards that goal. In particular, Renault worked with local companies, some of whom had no experience of the car business, in order to find smart solutions to both reduce costs and meet the functional requirement. Without a strong leadership and true oversight on the details, the project would have never succeed.

Low cost carriers for the African market. Five tips from the car industry.

From the successful launch of a low cost car by a mainstream manufacturer, one would wonder if any findings can be relevant for a new carrier in Africa, and by extension a new low cost carrier? I will respond in the affirmative, the best answer being that a traditional manufacturer did completely rethink its process to meet the market demand and reach new markets. Besides the power of will – witnessed by setting ambitious goals – agile innovation is a key of success.

Let’s go through the five key learnings for an investor hungry for success, and who aims to last more than few years in the African Sky!

1. Do not adapt a model, build yours!

Larry Tesler is the computer scientist credited for the invention of the cut, copy and paste function. But can you imagine a modern consultant or strategic airline advisor without cut, copy and paste? Unfortunately not. From the business model to the business case, the twisting of a recipe designed in a different market, with other constraints, for other customers, seems the norm. But the norm is not always the solution, as quickly discovered by the shareholders paying the bill. You need to start with a clean sheet of paper, starting from your operational, commercial, and competitive environment. By building up your airline in consideration of these requirements, you will have better roots to start up your business, and overcome the inevitable hurdles such a project will have to confront.

2. Be a smart-Jet setter!

The typical workhorse for a low cost carrier are the A320’s and B737’s of the world. A 150-200 seater is definitively a good fit to serve open sky markets which have an existing or emerging middle class, and taxes allowing the company to fill in 90% of these seats on average. But this is not the reality of the African market. Sukhoi Super Jet, Bombardier C Series or Embraer E Jet are all very competitive aircraft, more adapted to the economics of any African operation! They are not regional jets, but flexible small trunk-liners with extensive trans-continental range. This means that the 100-130 seats aircraft can compete with Airbus and Boeing across all narrow-body routes, with an important cost per seat advantage.

3. Be Agile!

The old school mantra was all about fleet planning, twisted to marketing planning when revenue management appeared in the 90s. But still, the Plan-Do-Control model with its functional silo view still exists. This is characterized by what will appear anachronist in any other business: the IATA seasons. You need to have marketing agility and continuously adjust and enhance your flight schedule, since agility is your key competitive advantage against large carriers. Why should you follow the IATA seasons to design and commercialize your network? Is it not the market demand that should be the sole judge of your flight schedule? Agile marketing is the future, and this is what you should embrace.

4. Co-operate!

In a fairly constrained environment – with restrictive bilateral agreements, high cost of operations, and with limited mass markets – the ‘go it alone’ approach could also be a ‘fail on your own’ strategy. Low cost carriers in Africa should follow a cooperative-competitive approach, whereby circumventing restrictive agreements requires cooperation between airlines on a specific set of markets while still competing elsewhere. AFRAA, for example, is providing an actionable platform, the Route Network Coordination project, upon which even a low cost carrier should actively participate. Ultimately, it is always better to add some traffic all together, rather than let others enjoy the benefits of the current capacity vacuum!

5. Profit is in the value!

It’s a pretty common sense statement, but sometimes it seems the least shared ability. If you know your customers and operating environment, you know exactly the value increment you are offering to your future customers. Thinking about value will help you specifically define where the potential cost savings are, identify which service is eligible for ancillary-sales or should be part of your mainline offer, and understand when to move away from direct service to having circular flights and use 5th freedom rights. One could continue on this theme more. In short, your intrusive oversight is on value and should be the razor focus for an investor towards its managers.

Planet Optim big data can help LCCs to define their African opportunities.

Our web-based software enable airlines to predict traffic and revenue for new routes, even where there is no historic data.

Thinking about starting a low cost carrier in Africa? Or rethinking your business? These Top Five key success factors should be in your mind all day long! Our example of the automotive industry proves that you can be very successful by going beyond what the ‘old school thinkers’ believe is the recipe for success.

You might also be interested to know that our Planet Optim web-based software enables airlines to predict traffic and income for new routes … even where there is no historic data. Our 1.5 terabyte World Aviation Database uses 100 sources of industry data and third party big data to help airlines discover and evaluate new routes and partnerships. Research which used to take days or weeks is condensed into a few minutes with Planet Optim, enabling multiple ‘what if’ scenarios to be explored with ease.

I always welcome comments, feedback, and suggestions: let me know yours!”

Notes:

(1) Source: Roland Berger Strategy Consultants, Automotive Insights 2/2014: re-arranging BRIC.

(2) The elements in this section are using a report on the Indian economy written by Vikas Sehgal from strategy&, a subsidiary of PwC, on February 11 2011 – Indian Automotive Market 2020.

(3) Source: Milanamos air traffic data and forecasts.

(4) For more information about the Renault Kwid project, please read the research paper “From the Logan to the Kwid. Ambidexterity, reverse and fractal innovation, design-to-cost: recipes from Renault’s Entry strategy”, Bernard Julien, Yannick Lung, and Christophe Midler, Cahiers du GRETHA – CNRS 5113, July 2016.

Find out more about PlanetOptim. Get a demonstration.

If you’d like a no-obligation demonstration, please email demo@milanamos.com.